As the world grapples with the growing threat of climate change, innovative market-based solutions like carbon credit exchanges have emerged as powerful tools to curb greenhouse gas emissions. These exchanges provide a structured platform for businesses and individuals to trade carbon credits, incentivizing sustainable practices and driving global efforts toward a low-carbon economy.

By putting a price on carbon emissions, carbon exchanges not only encourage organizations to adopt cleaner technologies but also foster international collaboration in the fight against climate change. In this blog, we explore the significance, mechanisms, and future potential of carbon credit exchanges in shaping a more sustainable world.

What is Carbon Credit Exchange

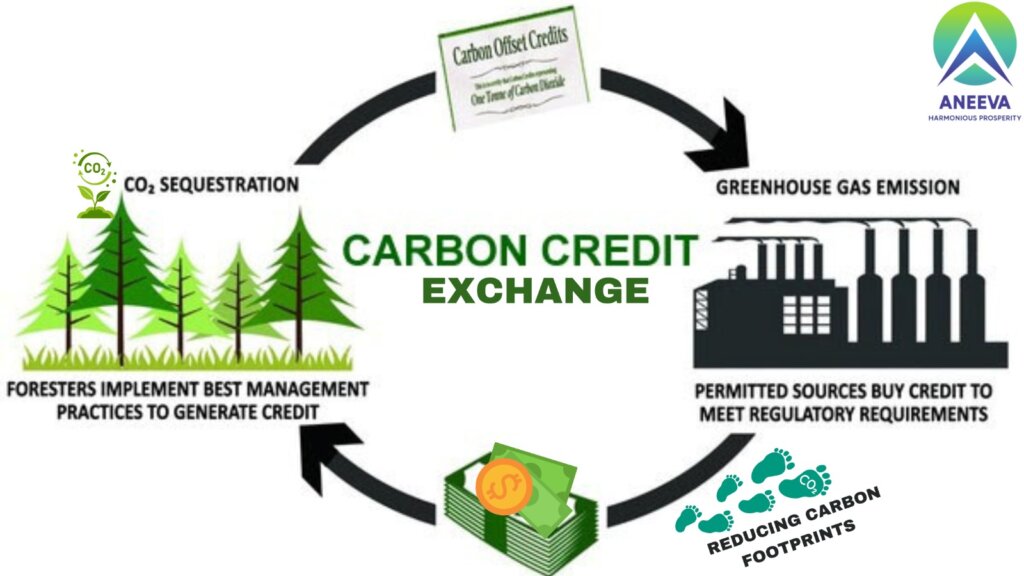

Carbon credit exchange is a kind of financial market that facilitates the trading of carbon credits. These credits represent the right to emit a specific amount of greenhouse gases, such as carbon dioxide (CO2). They are a critical component of emissions trading systems designed to limit and reduce greenhouse gas emissions.

Importance of Carbon Credit Exchange

Carbon exchanges play a vital role in addressing climate change and achieving sustainability goals.

- Incentivize Emission Reduction: By putting a price on carbon emissions, carbon exchanges encourage organizations to reduce their carbon footprint.

- Foster Innovation: Companies get rewards to invest in cleaner technologies and processes to earn and sell carbon credits.

- Global Cooperation: Carbon exchanges facilitate international cooperation by allowing businesses from different countries to participate in emissions trading.

- Compliance: Many countries and regions have regulations that require businesses to offset their emissions by purchasing carbon credits.

Carbon Exchange Mechanism

Carbon exchanges operate on a simple principle: supply and demand. Here’s how they work:

- Issuance of Carbon Credits: Governments or regulatory bodies set emission caps for companies. If a company emits less than its cap, it earns carbon credits.

- Trading: Companies with excess carbon credits can sell them on carbon exchanges to other organizations exceeding their emission caps.

- Price Determination: The price of carbon credits fluctuates based on market demand, the stringency of emission caps, and other factors.

- Transparency: Carbon exchanges ensure transparency by tracking and verifying emissions and credit transactions.

Types of Carbon Exchanges

There are various types of carbon exchanges, including:

- Compliance Markets: These exchanges cater to businesses obligatory to comply with government-mandated emission reduction targets.

- Voluntary Markets: Companies and individuals participate voluntarily in these markets to offset their carbon emissions and demonstrate environmental responsibility.

- Regional and International Markets: Some exchanges operate at a regional level, while others facilitate global trading of carbon credits.

Benefits of Carbon Exchanges

Here are the key benefits of carbon exchanges:

- Emission Reduction: Carbon exchanges directly contribute to a reduction in greenhouse gas emissions.

- Market-Based Approach: They promote market-driven solutions to environmental problems.

- Economic Opportunities: Carbon trading creates financial opportunities for businesses involved in clean energy and emissions reduction.

- Global Environmental Impact: By connecting markets worldwide, carbon exchanges contribute to a collective global effort to combat climate change.

Challenges and Criticisms

- Market Volatility: Carbon credit prices can be volatile, which may discourage long-term investments.

- Complexity: Navigating the intricacies of carbon markets can be challenging for smaller businesses and new participants.

- Integrity Concerns: Ensuring the integrity of carbon credits and preventing fraud is an ongoing challenge.

The Future of Carbon Credit Exchange

The future of carbon exchanges looks promising:

- Expansion: As more countries implement emissions reduction measures, the carbon market is expected to grow.

- Technological Innovation: Blockchain and other technologies may enhance transparency and security in carbon credit transactions.

- Integration with Green Finance: Carbon markets may become more closely integrated with sustainable finance initiatives.

Getting Involved

Interested in participating in carbon exchanges? Here are some steps to consider:

- Understand the Basics: Educate yourself about carbon markets, emissions trading, and carbon credit standards.

- Assess Your Emissions: Calculate your organization’s carbon footprint and identify areas for reduction.

- Engage with Experts: Consult with experts or firms specializing in emissions reduction strategies.

- Participate in the Market: Start buying or selling carbon credits on recognized carbon exchanges.

Conclusion

Carbon credit exchanges are at the forefront of the fight against climate change. By providing a mechanism for organizations to offset their emissions, they play a pivotal role in transitioning to a more sustainable future. Whether you’re a business looking to reduce your carbon footprint or an investor seeking environmentally responsible opportunities, carbon exchanges offer a pathway to positive change for our planet.